TAX AUDIT

The Tax Audit verifies and analyzes the control of compliance with Tax, Municipal and Sectoral obligations. The main function is to check for flaws in the processes, errors in tax payments or fraud and to indicate the best way to correct them.

The Audit of Accounts or Financial Statements differs from that of Tax Audit in that it analyzes the entity’s assets by verifying the application of the Accounting and Financial Reporting Standards (NCRF), based on the International Accounting Standards (NIC) and the Standards International Financial Reporting Standards (NIRF), issued by the IASB (International Accounting Standards Board), and ratified by the Republic of Mozambique through Decree 70/2009 of 22 December (SCE – Corporate Accounting System).

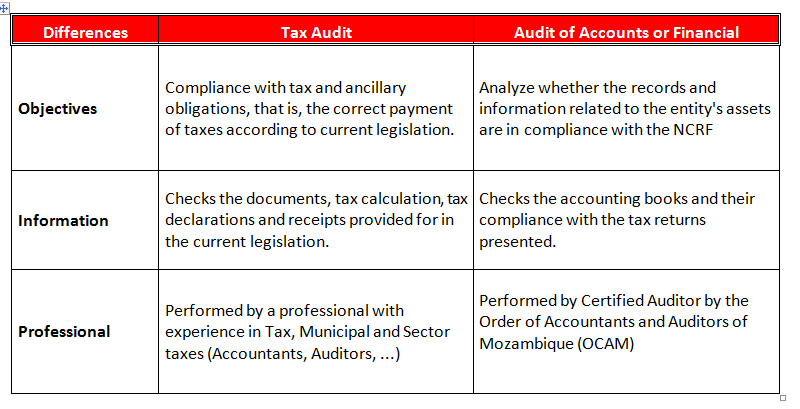

The main differences between Tax Audit and Audit of Accounts are shown in the following diagram:

The Tax Audit is a security for the company that its processes are in accordance with the current legislation.

The Audit of Accounts is a guarantee that the company’s assets are reliable, and for the registration of the documents, it complied with the Accounting and Financial Reporting Standards.

The Tax Audit work must be performed by a consultant independent from the entity, with the function of making the comparison between, the taxes paid and actually delivered or paid to the state. The benefits for the entities translate into the prevention and correction of problems, tax recovery.

FR ACESSORIA, SA, when carrying out the Tax Audit to our clients, guarantees security in the fulfillment of the payment of taxes, in addition to providing legal mechanisms for the elaboration of a tax planning that allows its institution to reduce tax expenses.