THE DEBT EASILY ENRICHES COMPANIES.

Debt as a business financing instrument increases, its financial risk manifesting itself in the company’s inability to meet its payment commitments on the agreed date of its amortization.

The outline of the financial risk contracted by companies when contracting the debt goes through treasury planning, for short-term loans or investment in assets, for long-term loans.

The cash flows of the business or company must cover debt services over the time horizon of the investment, this condition is essential for minimizing financial risk, in addition to the need for rational management of treasury with customers, suppliers and stocks.

The debt after taking care of a whole financial analysis to ensure the cash balance, is a financing instrument that facilitates, the rapid growth and enrichment of the company, with less effort in the use of resources, such as the partners’ money, which is scarce in the small, medium or large business investment.

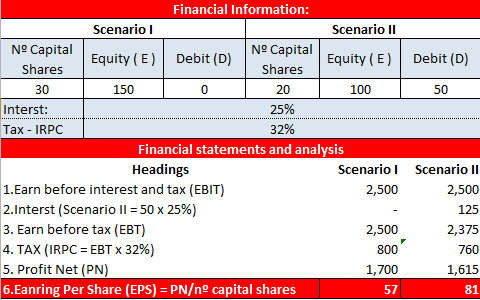

The two financial scenarios below explain in detail how, the debt easily enriches the partners, for this purpose the profit obtained per share (EPS) invested in the business is used as a measurement indicator, now let’s see:

FR ACESSORIA, SA, in accordance with good business management practices, offers its services in the elaboration of business plans, which is essential for companies, in contracting bank loans in accordance with Communiqué 01/2020 regarding the implementation about, the Single Index of the Mozambican Banking System celebrated between, the Bank of Mozambique (BM) and the Mozambican Association of Banks (AMB).